Are you ready for a marathon retirement?

Whether we retire at age 60, 70, or 80, we need to be prepared for a long retirement. The world’s centenarian population is expected to grow eight fold by 2050 according to a Pew Research Center report of United Nations estimates, with Americans leading the pack in...

GOT FREE DINNER ?

Have you been to a Free Dinner Retirement Event lately? My firm offers these Free Dinner Events regularly. It is my way of meeting nice people who are interested in what we do as a firm and learning how I might can help them. The invitations target those...

GOOD NEWS FOR RETIREES!

President Trump has recently proposed much needed changes involving Required Minimum Distributions (RMDs) from IRAs. The proposal, if passed, will extend the age in which a retiree must begin to take withdrawals. At present, RMDs must begin on April 1st following the...

What sent stocks down on the eve of earnings season?

Two factors drove the over 5% drop of the three major U.S. equity indices. One, fears over rising interest rates, and Two, a big selloff of tech shares.1,2 Closing market bid yields for the 10-year and 2-year note were barely changed from Tuesday at 3.22% and 2.88%,...

Will You Need A Support Group in Retirement?

There are all sorts of support groups for people going through transitions. There are programs for those struggling with the loss of a loved one, addiction, anger, and divorce, but there aren’t any groups for people struggling with retirement. There’s a...

Heartbreaking Reasons To Save Outside Of A 401k, 403b, Or IRA For Retirement

An advisor friend shared two frightening withdrawal requests from retired clients that many investors would like to assume would never happen to them. The first was an $85,000 call for funds to cover rehab costs for an adult child. The lethal combination of depression...

Retirement Strategies for Couples With Considerable Age Differences

While the typical age gap between married couples is slightly less than four years, couples with age difference of 10 years or more have a few planning opportunities particular to their situation that they need to understand and manage. Take Advantage of 401(k)...

Disability Insurance — Who Needs It?

Your most valuable asset isn’t your house, car or retirement account. It’s the ability to make a living. Disability insurance pays a portion of your income if you can’t work for an extended period because of an illness or injury. Everybody who relies on a paycheck...

Stop Focusing On Your Retirement Planning Mistakes

Retirement mistakes come in all different shapes and sizes with some of the most popular being: •Not saving enough •Not saving at all •Taking a loan against a 401(k) or 403(b) •Withdrawing and spending a former employer's retirement plan instead of rolling it over...

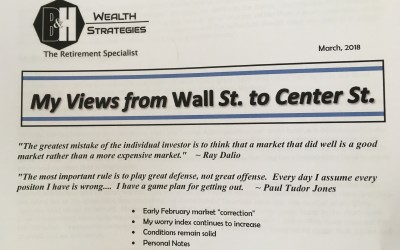

My Views from Wall St. to Center St.

My Last "views" included my predictions of the 2018 capital markets. I stated that I thought the U.S. and most global markets would be positive for the year. That date was (Read more)